Скачать клипы Inkomstenbelasting , nivellering, denivellering ↓

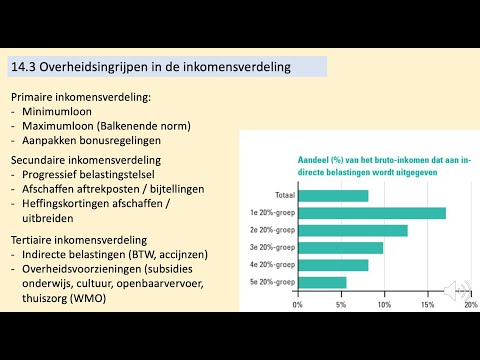

Inkomstenbelasting (belastingschijven), nivellering, denivellering - Economie voor havo - Jong & Oud

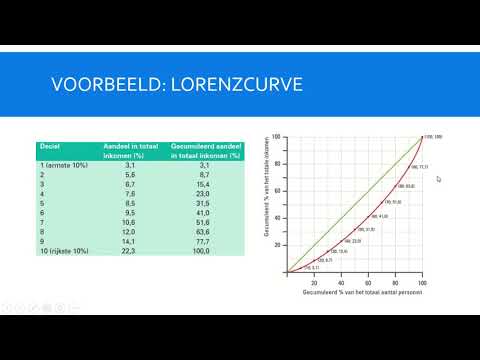

Lorenz curve, leveling, de-leveling, income distribution - Economics for pre-university education...